|

New Infield Forecast:

Fixed Platforms Market Report to 2017

Infield Systems has just released the latest edition of its Global Perspectives Fixed Platforms Market Report to 2017. The new report provides a comprehensive forecast for fixed platform capital expenditure and installations over the next five years, covering the full range of platform types (Piled, Gravity Based, Gravity/Jack-up, Caisson, Jack-up, Suction Pile). The report provides analysis at both a global and a regional level, looking at fixed platforms by region/country, by operator, platform type, water depth and weight. A detailed analysis of macro market conditions as well as a summary of key prospects by region is also included.

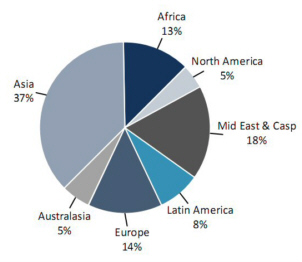

The outlook for the global fixed platform market is positive, with the market projected to see an increasing level of investment over the next five years. With Asia's ever increasing demand for energy to fuel its growing economies, the region is likely to remain the key focus for fixed platform investment during the forecast and beyond. In fact, Asia is projected to account for a majority 37% share of global fixed platform Capex as well as 42% of the installation market. Aside from the traditional areas of fixed platform production, emerging markets such as Africa, and in particular West African countries, are expected to fuel demand and account for a growing share of the market in the future.

Within Asia, China will be a key driver of demand, as it attempts to sustain economic growth and reduce its reliance on foreign imports. Malaysia is also expected to continue to be a key player as the country needs to support its foreign and domestic demand. The recent budget announcement, which saw the Malaysian Government commit to providing a favourable tax regime for oil and gas companies for a ten year period, is likely to incentivise growth within the industry.

Fixed platform Capex levels in Africa are expected to be robust, exceeding levels seen during the historic period in every year of the forecast. Angolan and Nigerian developments continue to be the key drivers of demand with IOC's and some Independents carrying out some major fixed platform developments. Chevron is one of the key players in the region; with its Mafumeira project in Angola forecast to require substantial investment relating to the development of its associated fixed platforms. The company's fields in Nigeria are also expected to require significant expenditure over the forecast period to capture more of their associated gas.

Within Europe, Capex spend on fixed platform projects is expected to be 53% higher in comparison to the last five years, and in Australasia major developments which are scheduled to take place offshore Australia's North West Coast should also provide long term support to the market.

Investment prospects in the other regions are more mixed. In the Middle East, despite a slight drop in Capex compared to the historic period, Iran's NOC NIOC is expected to continue to invest significant Capex for its various planned development phases of the South Pars field. Turning to Latin America, its share of the fixed platform market is projected to shrink slightly due to the reduction of activity in Mexico. However, the region is still expected to see a 29% increase in expenditure over the forecast period in comparison to the last five years. Finally, the Macondo incident in the Gulf of Mexico, along with booming onshore unconventional gas production has led to a decline in shallow water production in the US in recent years. However, with high oil prices, there is a renewed effort to exploit small shallow water reserves which could boost the country's demand for fixed platforms in the future, and as such, there could be a recovery in the North American market towards the latter part of the forecast to levels not seen since 2008.

IOC fixed platform investment is forecast to increase over the next five years, with Chevron taking the leading position in terms of capital investment. NOC's are also expected to see increased levels of expenditure over the forecast mainly fuelled by NOC's operating in Asia and in the Middle East & Caspian regions. Malaysian NOC Petronas is forecast to see the highest levels of NOC expenditure. The company is forecast to work on a number of fixed platforms globally, and thus, is not tied solely to activities in its parent country. Independent operators will also command a sizable chunk of market Capex over the forecast, with Asia and Europe projected to be key regions for independent operators.

Historically, operators have preferred to use conventional piled platform installations in shallow waters, and this trend is not expected to change during the forecast. The one exception is the US Gulf of Mexico market where caisson platforms have been favoured by operators in ultra-shallow waters. During the forecast, however, Europe is also expected to see its fair share of caisson platform installations, mainly driven by activity in the UK. Unconventional platforms, particularly gravity based platforms make up a small but significant part of the forecast, accounting for 8% of total forecast Capex.

In terms of water depth, Infield Systems expects to see an increase in Capex across most water depth categories. Platforms situated in the 25-50m and 51-75m water depth categories are expected to account for the largest share of the market during the forecast, with platforms situated in the 25-50m water depth category seeing the largest share of the installation market.

Download Brochure & List of Contents

Source: Quentin Whitfield, Infield Systems

quentien.whitfield@infield.com

July 31, 2013

|

Oil

& Gas Journal:

Worldwide more than 100,000

paid subscriptions

Learn

more

.

Invitation

from the

Oil & Gas Journal

and Offshore Magazine:

This

'Executive

Brief'

could be yours

Click

here ... and see what we have designed, produced, published and promoted for WIKA

and FMC Technologies ... and what we would like to do for you.

.

PennEnergy

Weekly

Video News

.PennWell Petroleum Group:

OGJ - Oil & Gas Journal

OGJ_eNewsletter

Offshore Magazine

Offshore eNewsletter

Oil & Gas Financial Journal

Oil, Gas & Petrochem

OGJ Russia

OGJ LatinoAmericana

PennEnergy

PennEnergy-eNewsletter

+ + +

For more information, media

kits or

sample copies please contact

wilhelms@pennwell.com

www.sicking.de

|